Category: Investing

-

Stock Market Lesson at the Poker Table

in InvestingI’m not the best poker player, but I make sure to brush up on my skills before occasionally trying my luck in Vegas. One of my favorite resources is Harrington’s book on poker strategy. The first time I put its lessons to the test, I found myself playing an overly cautious game. Harrington’s advice made…

-

Compounding

in InvestingAlbert Einstein supposedly remarked, “Compound interest is the eighth wonder of the world.” In investing, compounding is the magical process where your investment grows exponentially over time as your earnings generate their own earnings. This principle can turn modest savings into substantial wealth, given enough time and consistent returns. However, our brains often struggle to…

-

Alternative Assets: In the Doldrums

in InvestingHere is a recap of my posts over the last few weeks about “alternative assets”. The attached article from Wall Street Journal this weekend offers corroboration. ♒ Private Equity: The Tide Has Gone Out ♒Once heralded for capturing the coveted illiquidity premium, private equity now faces a daunting landscape. With interest rates higher and an…

-

Inflation-Linked Bonds: A Hidden Gem

in InvestingIn the vast landscape of alternative assets, inflation-linked bonds fly under the radar, overshadowed by the more glamorous private equity, venture capital, infrastructure, and real estate. But isn’t it time we rethink this overlooked category? Inflation-linked bonds stand out due to their low correlation with both stocks and nominal bonds, and they are an exceptional…

-

Commodities: Insights and Challenges

in InvestingCommodities gain traction from time to time as an alternative asset class. Their allure lies in their low correlation with traditional investments like stocks and bonds, coupled with their potential to serve as a hedge against inflation. However, the practicalities of investing in commodities present unique challenges. The first hurdle is the inherent difficulty in…

-

Private Real Estate – It. Is. Illiquid. Period.

in InvestingReal estate is a legitimate alternative asset class, offering a way to diversify portfolios heavily weighted in stocks and bonds. However, it comes with a significant caveat: it is inherently illiquid, as anyone who has tried to sell a home in a tough environment can attest. For decades, real estate firms have marketed Open-End Real…

-

Hedge Funds – The Emperor Has No Clothes

in InvestingOnce upon a time, a “hedge fund” referred to a strategy of balancing long and short positions in stocks to “hedge” market risk. Fast forward to today, and hedge funds have morphed into a wide array of investment vehicles, utilizing a wide variety of financial instruments, leverage, high fees, and strict withdrawal restrictions. They aim…

-

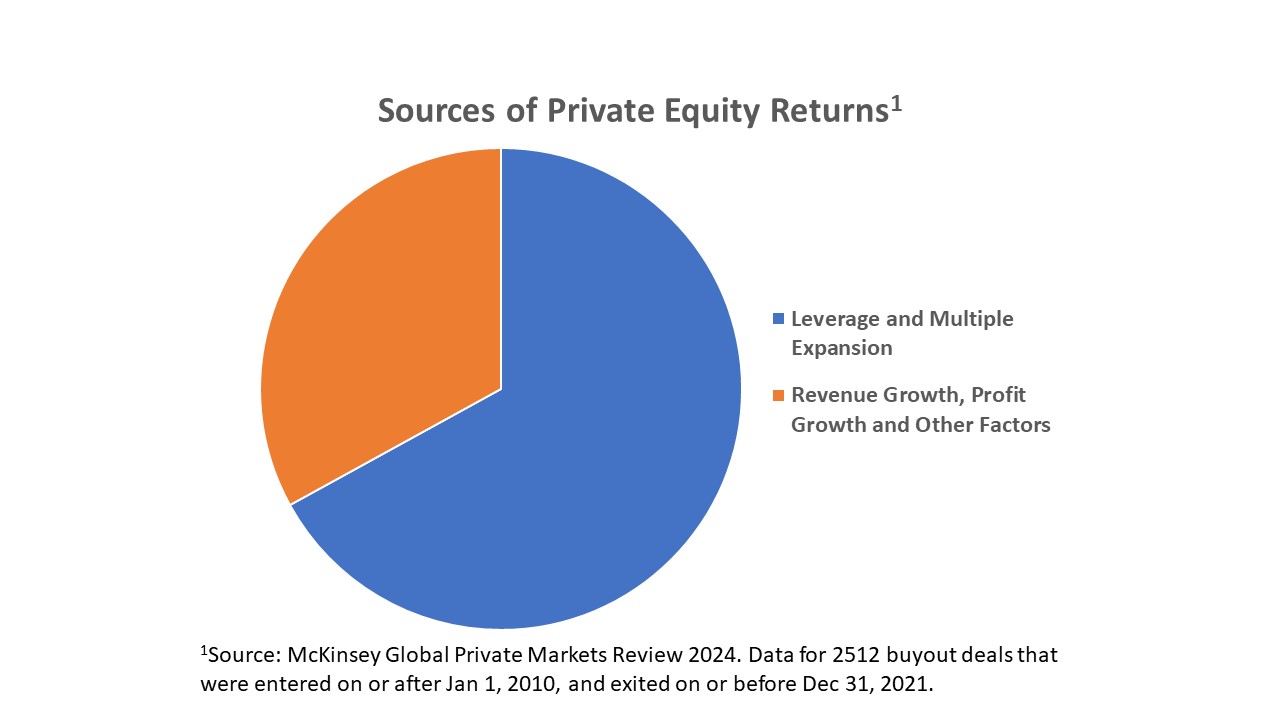

Private Equity – The Tide Has Gone Out

in InvestingTo predict the future returns of an asset class, a wise starting point is analyzing the components of past returns and projecting their future trajectory. Private equity (buyout) funds traditionally derive returns from four key sources: 1. Revenue Growth2. Profitability Growth3. Leverage Effect4. Valuation Multiple Expansion According to McKinsey’s Global Review of Private Markets 2024,…

-

“Alternative Assets” – The Bandwagon Effect is in Full Force

in InvestingHave you ever wondered why everyone seems to jump on the same investment bandwagon, whether it’s tech stocks in the ’90s or AI stocks last year? This is known as the Bandwagon Effect, a psychological force that pushes people to follow the herd rather than making decisions based on independent analysis. It’s fascinating, and tricky!…

-

Investing Milestones and Lessons (1974-2024)

in InvestingIn 13 bite-sized posts, I have had the pleasure of taking you on a whirlwind tour of some of the most pivotal moments in financial markets, and their lessons, over the past 50 years. Here’s a recap of the milestones we’ve journeyed through. 1974 – From Crisis to Innovationhttps://lnkd.in/dZmxNzfF 1976 – A Turning Point in…