To predict the future returns of an asset class, a wise starting point is analyzing the components of past returns and projecting their future trajectory.

Private equity (buyout) funds traditionally derive returns from four key sources:

1. Revenue Growth

2. Profitability Growth

3. Leverage Effect

4. Valuation Multiple Expansion

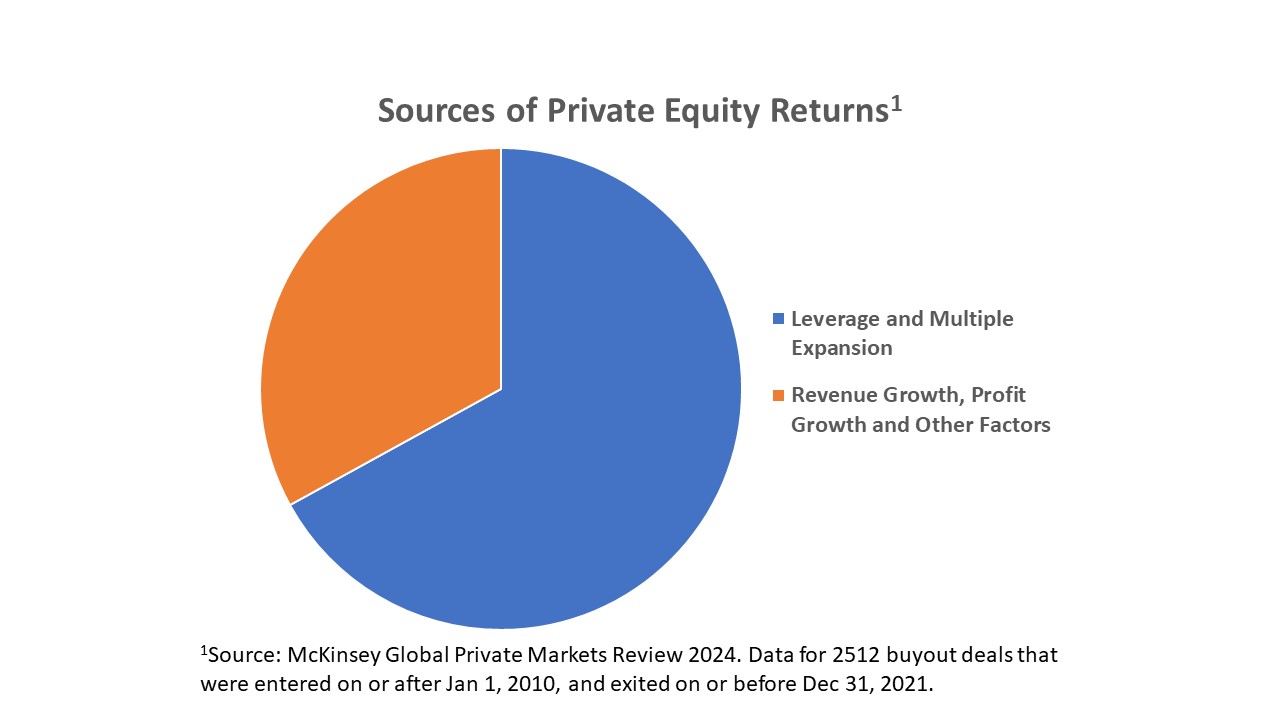

According to McKinsey’s Global Review of Private Markets 2024, the Leverage Effect and Valuation Multiple Expansion have been the powerhouse behind Private Equity returns accounting for two-thirds of performance over the last decade. But the winds have shifted; yesterday’s tailwinds are today’s headwinds.

With interest rates climbing, the once advantageous leverage effect has diminished. Meanwhile, valuation multiples are beginning to contract. If the leverage effect’s potency is halved and valuation multiples decline just a bit more, we could see private equity returns plummet to less than half of their historical figures.

Funds raised during 2020-2021 are clinging to their assets, refusing to face market realities by marking down or selling these assets. This approach only postpones the inevitable rather than preventing it.

The tide that once buoyed all private equity vessels has receded. A new tide is not on the horizon.

Proceed with caution!

Private Equity – The Tide Has Gone Out

in Investing